iMore – Jason Snell: “Or to put it another way, Apple’s non-iPhone business is generating about $80 billion in revenue every year — roughly the same as Microsoft. The Mac generates $24 billion per year, and the iPad (at the moment) generates around $20 billion per year. Put together, that’s roughly the revenue of Hewlett-Packard. Starbucks just reported its most recent quarterly revenue total: $5 billion, or roughly what the Mac generated in revenue last quarter. Facebook’s blow-out quarter? $5.4 billion in revenue.”

iMore – Jason Snell: “Or to put it another way, Apple’s non-iPhone business is generating about $80 billion in revenue every year — roughly the same as Microsoft. The Mac generates $24 billion per year, and the iPad (at the moment) generates around $20 billion per year. Put together, that’s roughly the revenue of Hewlett-Packard. Starbucks just reported its most recent quarterly revenue total: $5 billion, or roughly what the Mac generated in revenue last quarter. Facebook’s blow-out quarter? $5.4 billion in revenue.”

All the talk about Apple’s demise is definitely overblown. All the stock market cares about are companies that are growing. Those types of investors don’t care about the long term outlook of the company. All they’re interested in is how much they can make over the next few months. They’re gamblers, just like someone sitting at a Vegas craps table, rolling the dice. You win some, you lose some.

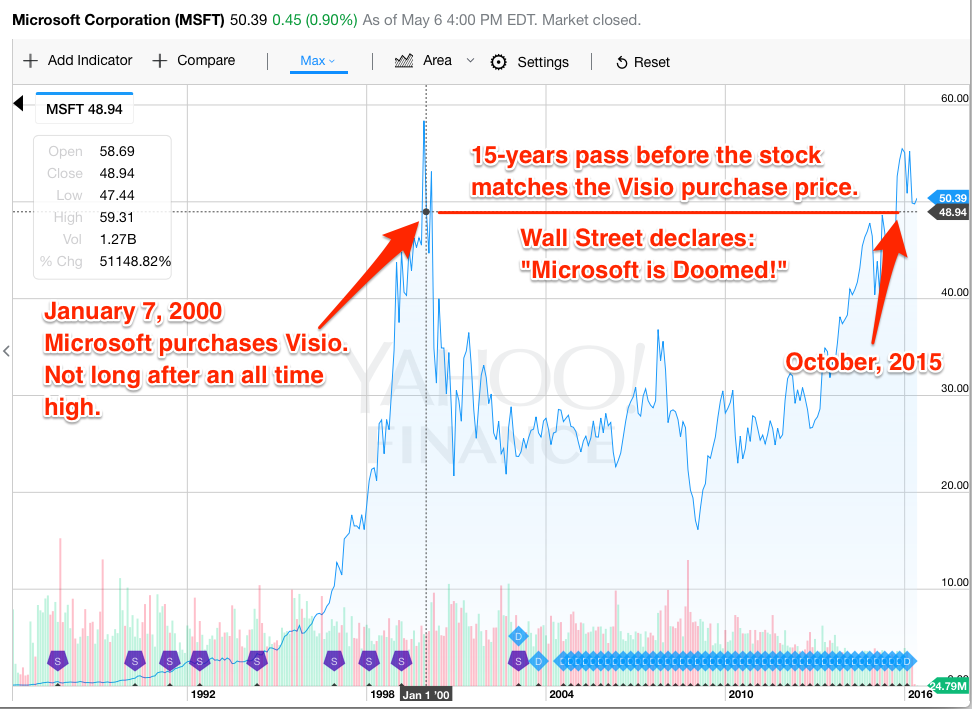

Back in 2000 when Visio was purchased by Microsoft we were at the end of Microsoft’s stock market rise. It pretty much stagnated for 15-years, sure it was up and down from that point, but it was inevitable they would see a dip, then become a steady “old” company. Not always on the rise, but also not on the cusp of disappearing. It may have taken a number of years but Microsoft stock has risen to 2000 levels. Will it stay there, fall, or continue to rise? Meh, who knows. Wall Street certainly doesn’t have a clue (remember, it’s a crap shoot.)

Here’s a pretty picture that points out Microsoft’s stock struggles for the last 15-years.

In the end Apple will be fine. They’re not going to disappear. They’ve never been a Wall Street darling. They’ll continue to be Apple. That means they will continue to perplex investors — who will continue to call for Tim Cooks head — which in itself is a complete mystery for a company that makes gobs of money for its investors.

In the end Apple will be fine. They’re not going to disappear. They’ve never been a Wall Street darling. They’ll continue to be Apple. That means they will continue to perplex investors — who will continue to call for Tim Cooks head — which in itself is a complete mystery for a company that makes gobs of money for its investors.

Maybe Apple is about to settle into being a steady company?